2022 can be seen as the second year of recovery for the European construction industry after the outbreak of the COVID-19 pandemic. However, the year-on-year growth rates of 3.0% were already significantly lower than in 2021 (+5.8%), and there is a reason for this: the sharp rise in construction costs.

The year 2022 has started very promisingly for the Austrian construction industry. In the survey results of the WIFO Business Survey at the beginning of the year, more and more companies reported a favourable assessment of business activity and their order situation. However, very quickly over the course of the year the economic climate deteriorated.

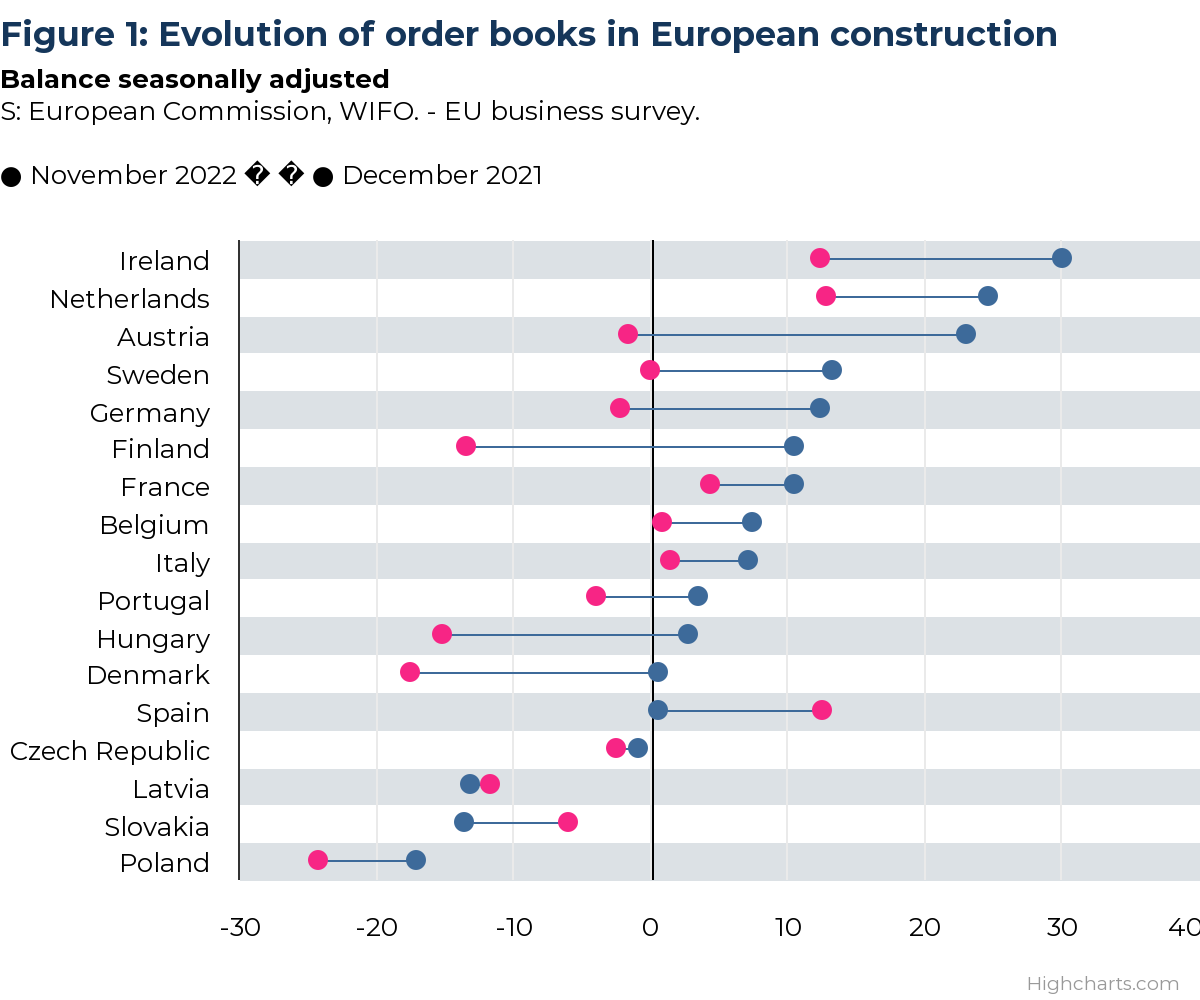

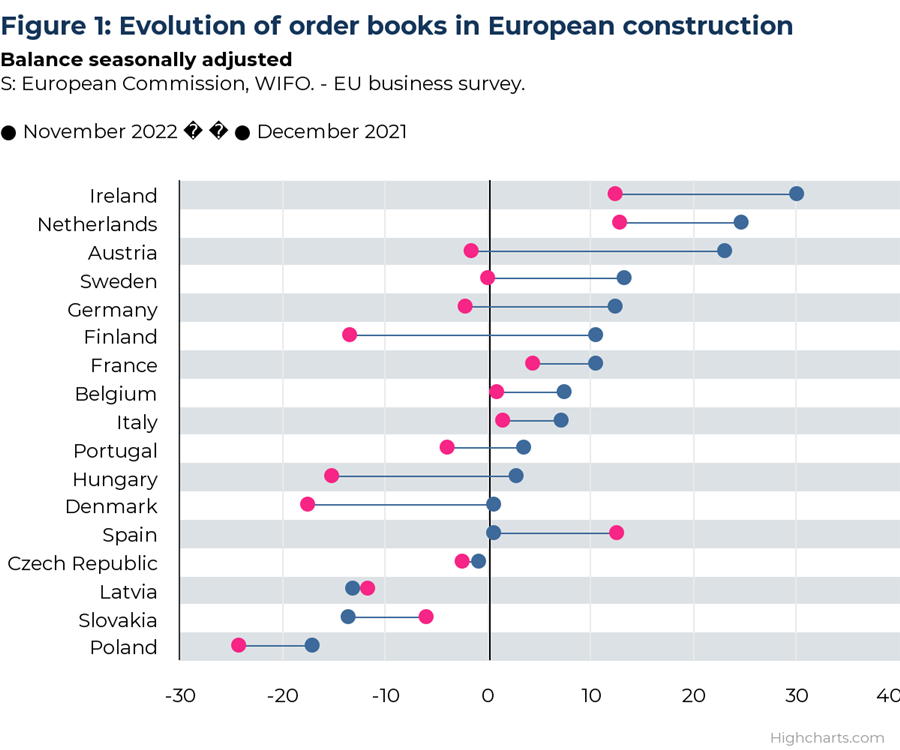

The comparatively fast deceleration of construction activity was not limited to Austria but became a dominant pattern across Europe. A comparison of business sentiment across countries shows the construction industry has lost pace all over Europe (see Figure below). And in many cases, the sentiment in the construction industry has already crossed from an optimistic to a pessimistic appraisal of the current situation. In the neighbouring countries of Germany, the Czech Republic, Hungary and Poland, the share of firms with insufficient order backlogs already predominates.

The major factor behind the rapid cooling of construction activity is undoubtedly the development of construction costs. The European construction industry has been hit by two consecutive cost shocks within a short period of time: In 2021, during the recovery phase after the COVID-19 pandemic, there were already significant cost increases, which were primarily due to the unexpectedly rapid economic recovery. And if at the turn of the year 2021/2022 it still looked as if the situation would calm down and the price increase as well as the material shortage would now weaken, the second massive cost shock within 12 months followed immediately with the Ukraine war.

In contrast to the cost increases in 2021, which were strongly accompanied by supply chain problems, the high energy prices as a result of the war are to be seen as a driving factor. Due to the very energy-intensive production technology of many building materials, there were significant price increases. A recent detailed analysis by the Austrian Institute of Economic Research (WIFO) illustrates that in addition to raw materials such as wood or bitumen, particularly sensitive increases occurred in steel and iron products as well as in fuels (including diesel). In sum, the two shocks lead to double-digit growth rates in construction costs in 2021 and 2022.

And although prices for some key construction materials such as steel have already started to fall – spot prices for steel products on the European commodity exchanges are already around 30% below the peak in spring 2022 – the year 2023 is not expected to experience a decrease in construction costs. Combined with the continued inflationary pressure and the resulting higher interest rates, the outlook for European construction industry is stable at best, and the risk of a collapsing demand for construction services is very real.

Texten är skriven av Michael Klien, expert på den österrikiska bygg- och anläggningsmarknaden vid WIFO - Austrian Institute of Economic Research. WIFO ingår tillsammans med Prognoscentret i det europeiska analysnätverket Euroconstruct som publicerar prognoser för nitton europeiska bygg- och anläggningsmarknader två gånger per år.

Kontakta oss för mer information om Euroconstructs prognoser och rapporter.